Forum for Tax Law

Introduction to the Forum for Tax Law

Forum for Tax Law facilitates collaboration between the faculty affiliated with tax law at CBS LAW. The main purpose with the Forum is to coordinate and showcase the broad variety of tax law activities that make up CBS LAW, which includes teaching, dissemination, research, and events concerning tax law. As it appears below, the Forum group members teach in a wide range of tax law courses that are offered across various CBS programmes. Apart from teaching at CBS, they also arrange national as well as international conferences and seminars, they participate in and disseminate at research seminars both nationally as well as internationally, and they publish research in widely acknowledged research journals.

Members of the Forum:

Events

Onsdag den 29. maj 2024 fra 16.00 til ca. 18.15 i auditorium C.0.33, stueetagen ved hovedindgangen til Dalgas Have 15, Frederiksberg.

Der vil indledningsvist være en kort præsentation af to nye fag på Master i Skat.

Efter introduktion til emnet ved studieleder, Professor Jane Bolander, vil TaxTalk stille skarpt på nogle centrale områder,bl.a. følgende:

• Bevis i skatte- og skattestrafferetten

• Bevis for fradragsberettigede udgifter til forsøg og forskning

• Særlige bevisbyrdemæssige udfordringer

OPLÆGSHOLDERNE ER:

- Professor, dr.jur. Jan Pedersen, Aarhus Universitet

- Partner Jakob Krogsøe, Advokatfirmaet Gorrissen Federspiel

- Partner Steffen Sværke, Advokatfirmaet Poul Schmith/Kammeradvokaten

- Professor, lic.polit, Michael Møller, Department of finance, CBS

Previous Events

2023

Seminar 15 December: 'Harmonising treaty-based anti-tax avoidance' with Visiting PhD Scholar Evan Collins

In this seminar, Evan Collins, will outline how a comparative view of general anti-avoidance rules can help us to understand the challenges to harmonising the Principal Purpose Test (PPT), a treaty-based general anti-avoidance rule (GAAR) which is now included in many tax treaties. The seminar will reflect on the text, design and purpose of the PPT, as well that of the GAARs from New Zealand and Canada, and recent case-law developments from these countries.

Bio:

Evan Collins is a Doctoral Student in Financial Law at the Faculty of Law at Lund University. His research seeks to analyse the Principal Purpose Test (PPT) a general anti-avoidance rule incorporated into many double taxation agreements as a result of the OECD Base Erosion and Profit Shifting project. The method of analysis is comparative law, and through researching the general anti-avoidance rules of New Zealand, Canada, Ireland and the United Kingdom, the goal of the research is to understand how the PPT might be applied within different states, and what challenges there may be to harmonizing the PPTs application across signatory states.

CBS Annual International Tax Conference 2023

The conference took place on 15 November 2023.

For program information.

You can find the full presentation here:![]() annual_cbs_international_tax_conference_2023_final.pdf

annual_cbs_international_tax_conference_2023_final.pdf

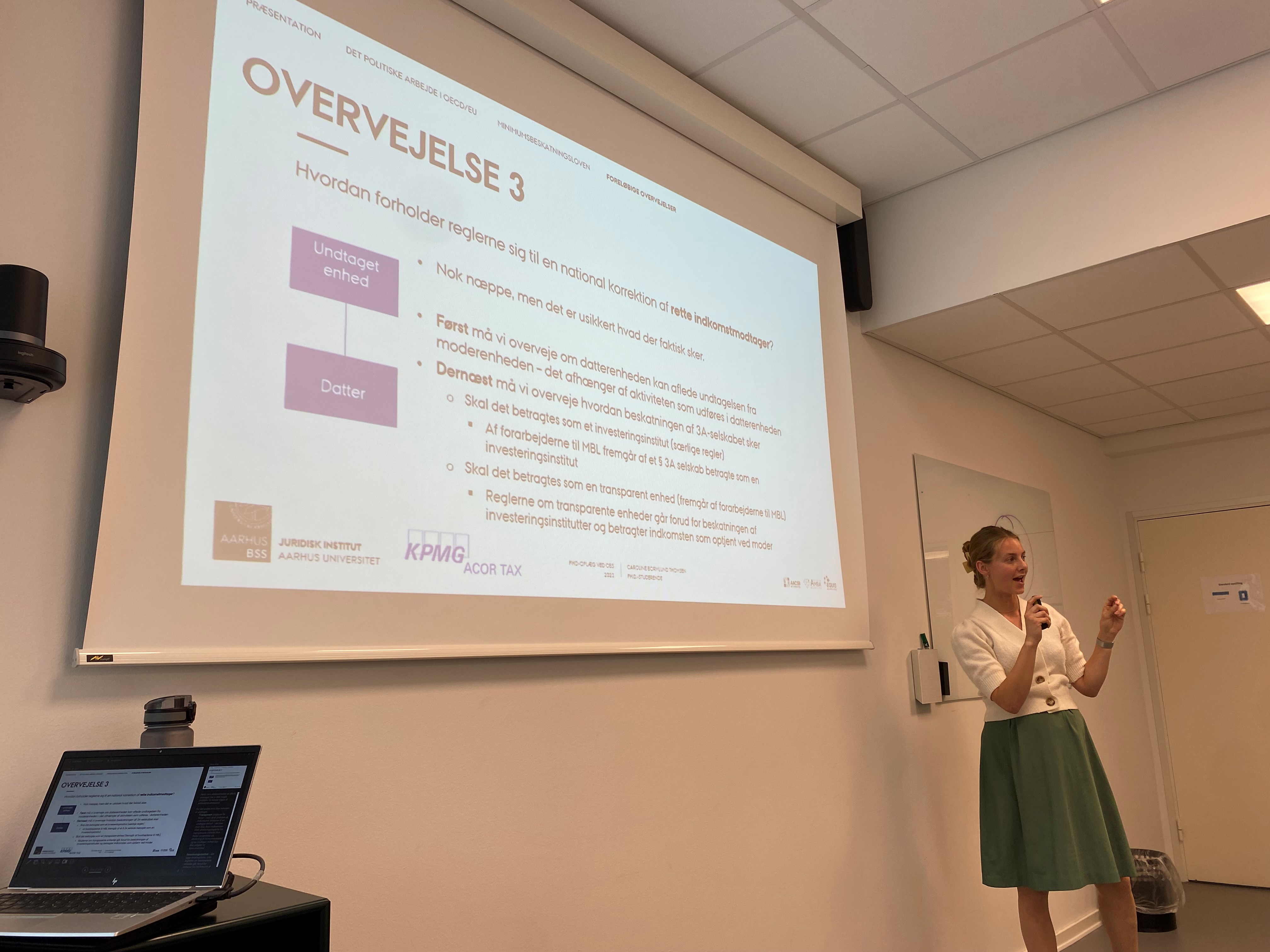

PhD Seminar with Visiting PhD Scholar Caroline Thomsen - 17 August 2023

Visiting PhD Scholar Caroline Thomsen – 'Implementeringen af reglerne om global minimumsbeskatning'.

You can find the full presentation here.

TaxTalk 2023 -- Skatteretten er et masseafgørelsesområde, hvor en række spørgsmål skal afgøres for et stort antal skatteydere. På grund af den store mængde kan ikke alle forhold individuelt behandles af fysiske personer. Der er store økonomiske gevinster ved at få mange af disse sager automatiseret. Automatiseringen vil imidlertid presse nogle borgeres retssikkerhed, idet ikke alle har samme forhold og forudsætninger – men hvor går grænsen?

Tidspunkt: Onsdag den 10. maj 2023 fra 16.00 til ca. 18.00 i auditorium C.0.33, stueetagen ved hovedingangen til Dalgas Have 15, Frederiksberg.

Information: https://efteruddannelse.cbs.dk/master/programmer/master-i-skat/events/taxtalk-2023.

2022

-

On 23 November 2022, we hosted the 2022 CBS Annual International Tax Conference on the topic of 'Climate Change and Tax Instruments -- How can tax law contribute to the green transition?', which included External Lecturer Jeroen Lammers as a speaker and was chaired by Professor Peter Koerver Schmidt.

-

On 14 June 2022, Professor Jane Bolander coordinated and hosted the event TaxTalk 2022: Efterrettelighed i gråzoneland (Compliance in grey zones) as part of the study program Master in Tax. Jane introduced the topic of the event in order to prime the participants for the subsequent interesting talks delivered by tax consultants and representatives from the Danish Ministry of Taxation.

-

On 31 March 2022, Professor Jane Bolander coordinated and hosted the event 'Masterclass' in connection to the master's programme Master i Skat.

2021

- On 11 November, we hosted the CBS Annual International Tax Conference on the topic of 'Morality and Corporate Tax', and External Lecturer Jeroen Lammers was among the speakers.

- On 30 August, 6 September and 13 September 2021, we hosted the CBS and Cambridge workshop series on financial crime: "Enablers of financial crime: Tax, Finance, and Societies" hosted by CBS Tax Group and Cambridge Tax Group (included in the Cambridge International Symposium on Economic Crime programme)

Dissemination

The postgraduate programme Master i Skat has been extended to include a course on ‘International Corporate Tax Policy’, which will be taught by Assistant Professor Jeroen Lammers starting Spring Semester 2024. You can read more about the new course and register here.

2023

- 4 December, Professor Peter Koerver Schmidt did a presentation regarding the European Commissions’ BEFIT proposal (Business in Europe: Framework for Income Taxation), COM(2023) 532 final at the FSR – Danish Auditors’ annual conference on International Tax Law. You can access the presentation here.

- 4 December, Assistant Professor Jeroen Lammers presented his PhD research on 'the Spirit of International Tax Law' at the FSR – Danish Auditors’ annual conference on International Tax Law. You can access the presentation here.

- 7 November, Assistant Professor Jeroen Lammers presented as national reporter of DAC7 at The Amsterdam Centre for Tax Law (ACTL)'s Conference on " EU Tax Reporting for Digital Platforms (DAC7): Comparing Member States' Approaches ".

- 12 October, Professor Peter Koerver Schmidt visited the Danish Tax Agency’s offices in both Copenhagen and Aarhus to present and discuss difficult issues related to the interpretation and application of the Danish rules on taxation of controlled foreign corporations (the “CFC rules”). You can access his presentation here.

- 5 October, Professor Peter Koerver Schmidt presented at the Tax Law Conference 2023 – Contemporary Issues at the Faculty of Law at the University of Bergen and the Norwegian School of Economics.You can access his presentation here: presentation_comparison_nordic_gaar_-_final_pdf.pdf

- 6 September, Assistant Professor Jeroen Lammers presented at the TRN Conference 2023 at the Faculty of Law, University of Cambridge. Jeroen's presentation was titled 'Improving Tax Treaties by Allowing Limited Double Taxation' and can be accessed here: improving_tax_treaties_cambridge_06.09.2023_final.pptx

- 21 August, Professor Peter Koerver Schmidt talked about 'Article-based thesis or monograph? Choice of format in a digital era' at the Danish/Swedish Tax Network's annual seminar at Örebro University in which multiple members of the CBS LAW Forum for Tax Law participated. You can find the full presentation here: dansk-svensk_skattenetvaerk_2023.pdf

- 21 June, Assistant Professor Jeroen Lammers succesfully defended his PhD thesis titled the Spirit of International Tax Law: From Fiscal Virtue to Mission-Oriented Moon-Shot at University of Amsterdam.

- 30 May - Assistant Professor Louise Blichfeldt Fjord was co-coordinator of the Young IFA Network's (YIN) tax law event titled 'Konference om skattepolitik, lobbyisme og rollen som en skattepolitisk interesseorganisation' (Conference on tax policies, lobbyism and the role of tax policy interest groups).

- 15 March - External Lecturer Jeroen Lammers presented at the WTS Global conference on Tax, Sustainability & Leadership with a presentation titled 'the case for international tax policy coordination and constructive business engagement in the fight again climate change

- 2 March - Assistant Professor Louise Blichfeldt Fjord was co-coordinator of the Young IFA Network's (YIN) tax law event titled 'EU's prioriteter på skatteområdet og den seneste udvikling' (The EU's taxation priorities and recent developments').

2022

- 17 November, Professor Peter Koerver Schmidt presented at FSR–Danske Revisorer’s Annual Conference on International Tax Law. Peter’s presentation dealt with recent developments with respect to rules on taxation of income in controlled foreign companies.

- 21 September, Professor Peter Koerver Schmidt presented at the Swedish branch of the International Fiscal Assocation (IFA) in University of Gothenburg. In his presentation, Peter spoke about the legal and moral obligations with respect to corporate taxation.

- 22 August, Associate Professor Michael Tell and Assistant Professor Louise Blichfeldt Fjord presented the main findings of the IFA General Reports 2022 at the Danish branch of the International Fiscal Association (IFA).

- 28 June, Professor Peter Koerver Schmidt was invited as a discussant at the Academic Symposium held in Oxford and organized by the Oxford University Centre for Business Taxation.

- 24 June, Professor Peter Koerver Schmidt and Assistant Professor Louise Blichfeldt Fjord jointly presented on ‘Digital Transformation and the Taxation Systems’ at the University Carlos III of Madrid conference titled ‘Digital Transformation of Government: Towards a Digital Leviathan?’

- 30 May - Professor Peter Koerver Schmidt hosted a seminar at Göteburg University, Sweden, on the topic of ”Legal Pragmatism – A Useful and Adequate Explanatory Model for Danish Adjudication on Tax Avoidance?” Link to the article hereto. For more information about the seminar, click here.

- 6 May - Professor Peter Koerver Schmidt contributed on the topic of legal and economic consequences of tax avoidance at the University of Reykjavik. His talk is titled 'Paying corporate tax -- an ethical and/or legal obligation'. Link to the event and research group.

- 21 April, PhD Fellow Maria Wriedt Keller held a WIP seminar in connection to her research titled ‘R&D Tax incentives, from a Danish and International perspective’.

- 1 April - Professor Peter Koerver Schmidt was invited to be part of preparing a new report for the Danish Tax Law Council, which focuses on "the third group" in the labour market. The report proposes various new measures for how the tax rules can be adjusted to accommodate this particular group.

- 31 March - Professor Peter Koerver Schmidt presented as a guest lecturer at the University of Padova on the topic of 'CFC legislation in a comparative perspective'.

-

31 March - Professor Jane Bolander hosted a seminar titled ‘Masterclass’ event in connection to the programme Master in Tax.

-

10 March - Assistant Professor Louise Blichfeldt Fjord was the moderator of a panel discussion on ‘The future of taxation of business income – Experiences from certain European jurisdictions’, and Professor WSR Peter Koerver Schmidt presented on the topic of ‘Implementing Pillar Two in the EU – The Path Ahead’ at the CORIT’s Celebrational International Tax Conference on 'Past and future international tax developments'.

-

Professor Jane Bolander was interviewed by the Tax Magazine Taxo (by Karnov Group), issue no. 02/22, for an article titled ‘Ingen grund til at være jubelidiot I skatteparadis’ (EN: No reason to be a moron in tax paradise).

Research

-

Assistant Professor Jeroen Lammers — The Case for an EU Cap on Interest on Underpaid Tax : Protecting the Internal Market. Intertax, Vol. 52, No. 1, 2024

-

Professor Peter Koerver Schmidt – Simplificering og harmonisering af selskabsbeskatningen i EU. SR SKAT 01-2024,

2023

-

Assistant Professor Jeroen Lammers — The Spirit of International Tax Law: From Fiscal Virtue to Mission-Oriented Moon-Shot. University of Amsterdam [PhD]. 2023

-

Professor Peter Koerver Schmidt – Formuebeskatning i Danmark: Aktuel debat om en gammel kending. Juristen, Vol. 105, No. 1. 2023.

-

Assistant Professor Mark Ørberg & Assistant Professor Louise Blichfeldt Fjord – Enterprise Foundations as ‘Non-profit Organizations’ Under the EU Pillar Two Directive [pre-publication]. Intertax, Vol. 51, No. 6/7. 2023.

-

Assistant Professor Louise Blichfeldt Fjord & Professor Peter Koerver Schmidt – The Digital Transformation of Tax Systems Progress, Pitfalls, and Protection in a Danish Context. Indiana Journal of Global Legal Studies, Vol. 30, No. 1. 2023.

- Professor Peter Koerver Schmidt – 'Driftsomkostninger og andre fradrag' in Christian Skovgaard Hansen; Troels Michael Lilja (ed.) Erhvervsbeskatning: Med fokus på personselskaber og virksomheds-ordningen. Djøf Forlag. 2023

- Professor Peter Koerver Schmidt – 'Internationale forhold' in Christian Skovgaard Hansen; Troels Michael Lilja (ed.) Erhvervsbeskatning: Med fokus på personselskaber og virksomheds-ordningen. Djøf Forlag. 2023

- Associate Professor Michael Tell – 'Avancebeskatning' in Christian Skovgaard Hansen; Troels Michael Lilja (ed.) Erhvervsbeskatning: Med fokus på personselskaber og virksomheds-ordningen. Djøf Forlag. 2023

- Assistant Professor Mark Ørberg & Professor WSR Peter Koerver Schmidt – Constitutional Limits on Taxation in Denmark. In: Review of International and European Economic Law, Vol. 2, No. 3, 2023

2022

- Professor Jane Bolander – ’Aktionærlån og maskeret udbytte – personkreds omfattet af ligningslovens § 16 E’. Taxo 2022 No. 7 Vol 34.

- Professor Jane Bolander – ’Løn i opsigelsesperiode, fratrædelsesgodtgørelse – lempelse efter ligningslovens § 33 A og dobbeltbeskatningsoverenskomst’. Taxo 2022 No. 7 Vol 34.

- Assistant Professor Louise Blichfeldt Fjord; Jakob Bundgaard – ‘Danish report: Big data and tax – domestic and international taxation of data driven business’. International Fiscal Association, Cahiers, Vol. 106 B, 2022.

- Associate Professor Michael Tell; Katja Dyppel Weber – ‘Danish report: Group approach and separate entity approach in domestic and international tax law’. International Fiscal Association, Cahiers, Vol. 106 A, 2022.

- Jacob Graff Nielsen; Professor WSR Peter Koerver Schmidt; Helle Vogt – ’Denmark’. In History and Taxation: The Dialectical Relationship between Taxation and the Political Balance of Power. IBDF. 2022.

- Professor Peter Koerver Schmidt – Direktivforslaget om global minimumsbeskatning i lyset af den fri etableringsret. SR-Skat, Vol. 34, No. 3, 4.2022.

- Professor Jane Bolander; Inge Langhave – Kryptovaluta – skatteretlige udfordringer i mødet mellem gammelt og ny. In: Festskrift till Robert Påhlsson. ed. /Nick Dimitrievski; Kjell Johansson; David Kleist; Stefan Olsson. Uppsala : Iustus förlag. 2022.

- Professor Peter Koerver Schmidt – 'Beskatning af arv og gaver med fokus på overdragelse af erhvervsvirksomhed inden for familien – forskelle i den dansk-svenske retsudvikling'. In: Festskrift till Robert Påhlsson. ed. /Nick Dimitrievski; Kjell Johansson; David Kleist; Stefan Olsson. Uppsala : Iustus förlag. 2022.

- Professor Jane Bolander – Skattepligtigt dødsbo? : Frivilling indbetaling af skat - Ydelse af gaver kort før arveladers død. SR-Skat, Vol. 34, No. 1, 2.202.

Grants

Forum for Tax Law has received funding from the FSR Foundation, which will be used to organize a research seminar in August 2024 under the auspices of the Danish-Swedish Tax Network and in connection to the cross-disciplinary research project anchored at the Department of Business Humanities and Law: 'Rethinking entrepreneurship'.

February 2023 - Grant by Carblsberg for the research project 'the Entrepreneurial Age: Rethinking Entrepreneurship in Society'

- In connection to Professor Christina Lubinski's (BHL) 20 million DKK grant by the Carlsberg Foundation for the research project 'the Entrepreneurial Age: Rethinking Entrepreneurship in Society', Professor WSR Peter Koerver Schmidt and the rest of the Forum for Tax Law aim to make a significant contribution to the project in connection to tax law.

The Nordic Tax Research Council generously decided to grant us funding for the annual CBS International Tax Conference on ‘Cross-Border Issues of Tax Policies Preventing Climate Change’. With the help of NTRC, we were able to host a prime conference with many international speakers.

Tax Law Courses in CBS Programmes

BSc in Business Administration and Commercial Law (HA(jur.)) and MSc in Business Administration and Commercial Law (cand.merc.(jur.))

MSc in Business Economics and Auditing (cand.merc.aud)

Master in Tax (Master i Skat)

Graduate Diploma in Business Administration (HD (regnskab))