Visit by Professor Neil Fligstein

Public Seminar with Neil Fligstein

In the beginning of June, Professor Neil Fligstein, from University of California, Berkeley visited the Platform and the Department of Business and Politics, CBS Centre for Business History and Department of Management, Politics and Philosophy.

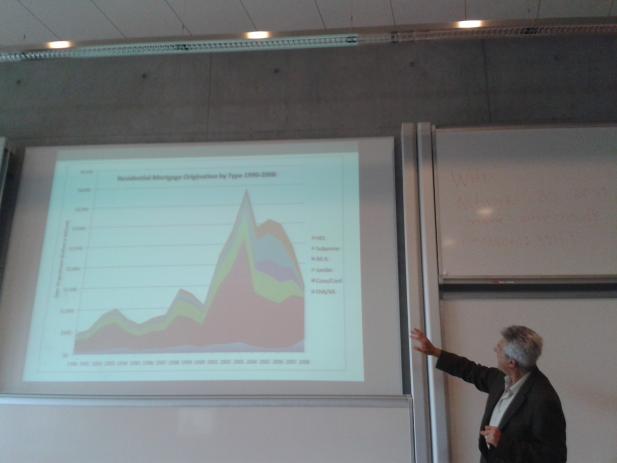

On June 4 he gave a public lecture on "The Transformation of Mortgage Finance and the Industrial Roots of the Mortgage Meltdown". According to Neil the 2007-2009 financial crisis was centred on the mortgage industry. In his wish to develop a sociological explanation of that crisis based on the markets as politics approach and the sociology of finance, Fligstein uses archival and secondary sources to show that the industry became dominated by an “industrial” conception of control whereby financial firms vertically integrated in order to capture profits in all phases of the mortgage industry. His results of multivariate regression analyses shows that the “industrial” model drove the deterioration in the quality of securities that firms issued and significantly contributed to the eventual failure of the firms that pursued the strategy. Furthermore his work shows that large banks which were more involved in the industrial production of U.S. mortgage securities also experienced greater investment losses. According to Neil the findings challenge existing conventional accounts of the crisis and provide important theoretical linkages to the sociology of finance.

Closed research workshop

During his stay the Public-Private Platform also hosted a closed workshop session for CBS researchers. The workshop’s theoretical background was based on one of Fligstein’s paper (published together with Adam Goldstein), which has received some press in the US: ”Why the Federal Reserve Failed to See the Financial Crisis of 2008: The Role of Macroeconomics as a Sensemaking and Cultural Frame“.

José Ossandón, assistant professor and cluster member, described about the workshop: “Neil Fligstein’s work has been very influential in at least two different subjects: the social history of the XX century corporation and how firms and other institutions politically shape markets. In his seminary at CBS, Fligstein presented a paper where he and his colleagues analysed the topics discussed at the board meetings of the main financial regulation in the US, the Federal Open Market Committee, in the years before the last financial crisis. The discussion at the seminar revolved around the main finding of the paper, namely, the regulators’ limited understanding of the financial industry resulting of the macro-economic concepts and methods in which they heavily rely on.”

Neil Fligstein is the Class of 1939 Professor in the Department of Sociology at the University of California. He is the Director of the Center for Culture, organizations, and Politics at the Institute for Research on Labor and Employment. He is the author of numerous books including "The Architecture of Markets (Princeton, 2001) and "Euroclash" (Oxford, 2008). Together with professor McAdam, Fligstein recently published the book ‘A Theory of Fields’ (Oxford, 2012). By combining insights from institutional theory, social movements theory, and organizational theory a creation of a general set of understandings of how new social spaces are constructed, maintained, and transformed. At the core of the book, is a distinctly sociological view of social action, one that is based on symbolic interactionism.

Read more about Neil Fligstein here.