Entrepreneurship students take more risks than others (but not at all costs)

Students during the experiments at Copenhagen Business School, November 2014

With the support from the CBS Entrepreneurship Bis Platform, a series of laboratory experiment were carried out at Copenhagen Business School with the aim of exploring these questions. During the experiments, students were faced with simple gambles. Every decision involved a real monetary gain. Gambles were presented in different combinations where the participants had to choose between certainty, risk and uncertainty.

Seventy five students enrolled in four different study programs at Copenhagen Business School (CBS) were invited to participate. We identified and compared four groups of students, two with entrepreneurial orientations (Ha-Ent and Copenhagen School of Entrepreneurship (CSE) students) and two without entrepreneurial orientation (HA-Almen and HD students).

Preliminary results show interesting differences between the groups of students both in their characteristics and observed behavior.

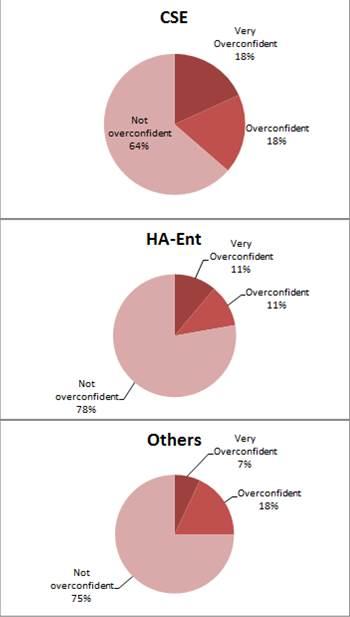

With respect to individual characteristics, we found that entrepreneurial oriented students in our sample are more overconfident than others when making choices (see Table 1). In other words, overconfident individuals show a stronger belief in their own knowledge as a guide to decision making. In our sample entrepreneurship students (HA-Ent) and non-entrepreneurship students (Others) have a similar share of overconfident people (approx 25%). However, the composition of the overconfident groups is very different between the two. In particular, entrepreneurship students present a higher share of very overconfident individuals (11%) compared to non-entrepreneurship students (7%).

Figure 1: Overconfident subjects in three samples (own elaboration)

Copenhagen School of Entrepreneurship students are also different from the other two groups. In our sample we find both a higher share of overconfident individuals (circa 36%) and a higher share of very overconfident individuals (18%). These results confirm the presence of overconfidence, a cognitive bias, in entrepreneurial oriented individuals. This characteristic is a key element of entrepreneurs when evaluating economic opportunities.

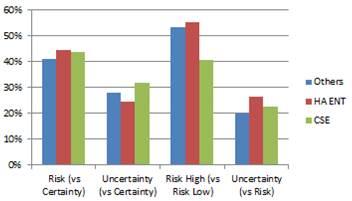

Figure 2 1: Gamble choices during the experiments (relative proportions).

With respect to gamble choices, our sample of entrepreneurship students has shown some interesting patterns (see Figure 2). Entrepreneurship students (both CSE and HA-ENT) appear to not choose risky and/or uncertain gambles “at all costs”. On the one hand, HA-ENT students appear to be relatively more risk takers in our sample (red bar) compared to CSE and non-entrepreneurship students. On the other hand, CSE students appear to be more prone to choose uncertainty when confronted with a certain monetary gain. As real entrepreneurs often face uncertain monetary opportunities, these results further underline the importance of distinguishing between risk and uncertainty taking when comparing entrepreneurs and other individuals.

The research group is continuing to mine the data with the aim of publishing in international peer reviewed journals.